Download Here SSFA’s Director, Kavitha Menon, contributed as a reviewer, supporting the paper’s development and offering insights on integrated approaches to implementing the Rio Conventions. Executive Summary The 2025 White Paper From Silos to Synergies outlines the progress and practical pathways for integrated implementation of the Rio Conventions. It highlights how countries are advancing from fragmented, […]

Singapore Sustainable Finance Association

Resources

-

-

04/11/2025Publications Feature

The Coalition To Grow Carbon Markets: Shared Principles for Growing High-Integrity Use of Carbon Credits

Download Here SSFA is proud to be among the supporting organisations of the Shared Principles for Growing High-Integrity Use of Carbon Credits. “High-integrity carbon markets are key to building market confidence. SSFA welcomes the Shared Principles as an important step toward greater alignment across governments on the credible use of carbon credits, responding to […]

-

26/10/2025Publications Feature

ASEAN Joint Statement on Climate Change to the 30th Session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC COP 30)

Download Here The ASEAN Common Carbon Framework (ACCF) was noted as an initiative aimed at accelerating the development of high-integrity carbon markets in ASEAN, through supporting the supply of high-quality carbon credits, strengthening demand signals, and advancing coordinated decarbonisation efforts with enhanced regional cooperation. Executive Summary WE, the Association of Southeast Asian Nations (hereinafter […]

-

23/09/2025Publications Feature

Joint Media Statement of the 57th ASEAN Economic Ministers’ (AEM) Meeting

Download Here The ASEAN Common Carbon Framework (ACCF) was highlighted as a key legacy initiative under the ASEAN Business Advisory Council, highlighting its role in strengthening regional business integration and supporting ASEAN’s transition towards a sustainable, low-carbon growth through enhanced public-private sector engagement. Executive Summary The Fifty-Seventh ASEAN Economic Ministers’ (AEM) Meeting was held on […]

-

19/09/2025Publications Feature

VCMI Publication – Catalyzing Carbon Markets: The Role and Opportunity for Financial Institutions

Download Here SSFA was featured in the paper through remarks by Director Kavitha Menon, who emphasized the growing importance of high-integrity carbon markets and the role of financial institutions in supporting carbon projects. She highlighted the paper’s valuable contribution to the ongoing dialogue on emerging opportunities and challenges, and reaffirmed SSFA’s commitment to continued engagement […]

-

09/07/2025Reports & White Papers

Guidance for Leveraging the Singapore-Asia Taxonomy in Green and Transition Financing

Download Here Executive Summary Southeast Asia’s public and private sectors are making significant strides in the climate transition, creating opportunities for financiers to direct capital towards credible green and transition activities. While green activity definitions are globally recognised among international taxonomies as contributing to outcomes aligned with the Paris Agreement, or with a 1.5-degree science-based […]

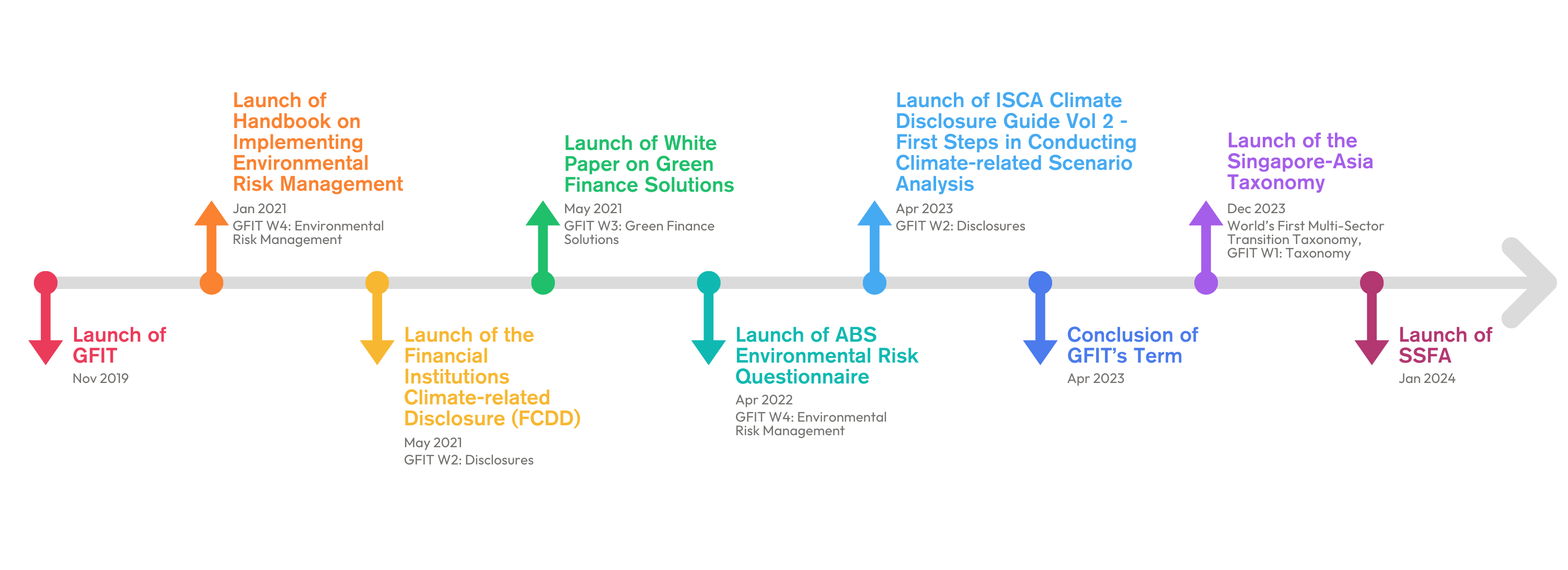

About the Green Finance Industry Taskforce (GFIT)

The Green Finance Industry Taskforce (GFIT) is an industry-led initiative convened by the Monetary Authority of Singapore (MAS) from November 2019 to April 2023 consisting of representatives from financial institutions, corporates, non-governmental organisations, and financial industry associations.

Key Objectives:

- Establish Singapore as the premier financial hub for green and sustainable finance in Asia;

- Leverage green and sustainable finance as one of the key approaches to achieving Singapore’s green agenda; and

- Identify best practices, as well as key measures and resources needed to develop the green and sustainable finance ecosystem in Singapore.

The GFIT advanced the three objectives through the following four key initiatives:

- Develop a taxonomy

- Improve disclosures

- Foster green finance solutions

- Enhance environmental risk management practices of financial institutions

GFIT Resources

Additional GFIT Resources

- ISCA Green & Sustainable Finance: Guide for SMEs

- ISCA Climate Disclosure Guide Volume 2 - First steps in conducting climate-related scenario analysis

- ISCA Climate Disclosure Guide - Taking First Steps Towards Climate-related Disclosures

- GFIT Financial Institutions Climate-related Disclosure Document (FCDD)